The Vision: To democratise early stage investing

Early stage investment is a vital source of funding for innovative start-ups. For investors, it is high risk but also potentially high reward. The Enterprise Investment Scheme (EIS) is a set of tax-based incentives offered by the Government to stimulate investment in start-ups. However, the Treasury has now restricted EIS to knowledge intensive companies, sitting at the risker end of the asset class. As a result, the potential was created for investors to exit EIS investing and for high potential UK SMEs to be starved of vital patient capital.

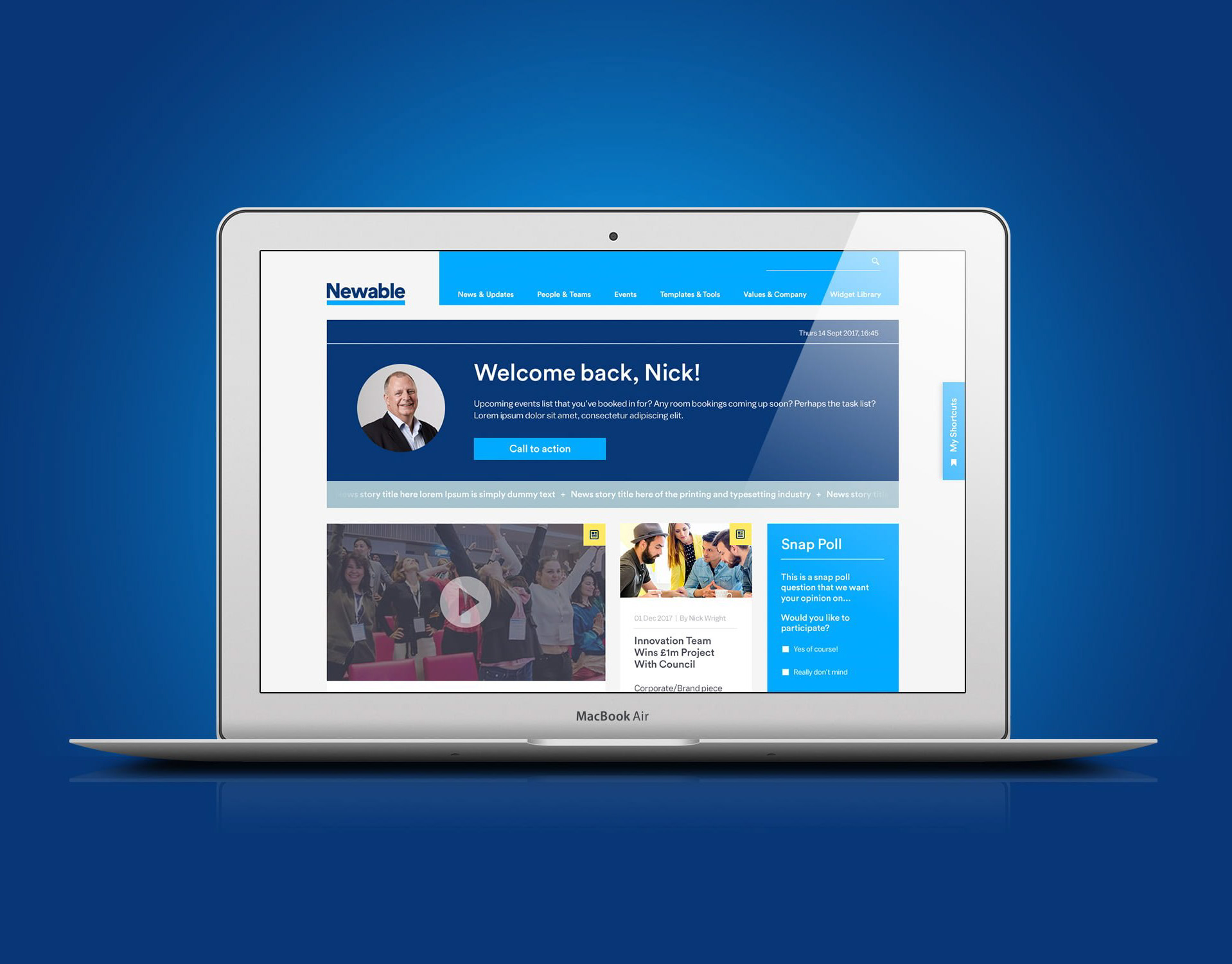

Early stage (angel) investing has long been a cottage industry, fragmented and seemingly closed to newcomers. The imperative and opportunity was to professionalise the sector. To help make entrepreneurs more investable; to help make the investor base more broad. And to create a trusted platform that facilitates, nurtures and monitors investments. It needed a brand to step up and become the authority in sector. Newable Ventures was that brand, and through a commitment to an extensive content marketing strategy was able to become the brand leader.

The Reality: Newable’s investor base increased by 30% across the campaign. There was also a 25% increase in the volume (and quality) of pitch decks submitted by entrepreneurs. Newable was crowned the UK’s most active early stage investment network.

Credentials with a purpose: https://bit.ly/3gajjTI designed by Undivided

6 part video series

Twitter & Linked social promotion of video series

Company presentation investment events

Proprietary research into inclusive early stage investing. https://bit.ly/2Za1zjn